EPC Financing

Unlock Energy Savings. Reduce Capital Investment. Achieve Sustainable Results.

What is the EPC Financing Model?

Energy Performance Contracting (EPC) is a financing model that allows businesses to implement energy-saving projects without upfront capital investment. In an EPC arrangement, energy efficiency improvements are financed through the savings generated by those improvements. The contractor designs, implements, and maintains the energy-saving measures, and the client repays the investment from the future energy savings, making this a risk-free way to achieve significant energy reductions while improving facility performance.

How Does EPC Work?

EPC allows you to make energy efficiency upgrades and improvements without the need for initial capital expenditure. The process typically involves the following key stages:

1. Energy Audit and Assessment

• Begin with a comprehensive energy audit to identify potential energy-saving opportunities.

• The audit provides the basis for the design and scope of work for the energy efficiency project.

2. Project Design and Planning

• Based on audit results, an EPC contractor will design a tailored solution that meets your facility’s energy-saving needs.

• The design includes technical specifications for energy-efficient equipment, systems, and processes.

3. Financing and Implementation

• The project is financed through the savings generated from the implemented energy efficiency measures.

• No upfront costs are required from the client. The contractor manages the installation, commissioning, and maintenance of the energy-saving technologies.

4. Guaranteed Savings and Payments

• Energy savings are guaranteed by the EPC contractor, and the client repays the cost of the project through the savings generated over an agreed-upon period.

• These payments are typically structured to be lower than the energy savings, meaning there is no out-of-pocket expense for the client.

5. Ongoing Monitoring and Maintenance

• The contractor monitors the performance of the energy-saving systems and maintains them to ensure optimal performance.

• Any necessary repairs, upgrades, or adjustments are handled by the contractor to ensure continued savings.

6. Completion and Post-Project Support

• At the end of the contract term, the energy efficiency improvements are fully paid off, and any additional savings continue to benefit the client.

Benefits of the EPC Financing Model

• No Upfront Capital: Start your energy-saving project without the need for large initial investments or budget approvals.

• Guaranteed Savings: The energy savings from the project are guaranteed, ensuring that the project will pay for itself over time.

• Reduced Risk: With a performance guarantee, you only pay for the energy savings generated—there’s no financial risk.

• Cash Flow Positive: The savings generated are typically greater than the cost of the project, making the process cash flow positive from day one.

• Sustainability Goals: Achieve significant reductions in energy consumption and carbon footprint without burdening your budget.

• Improved Facility Performance: Enhance the performance of your energy systems, improve building comfort, and reduce maintenance costs.

How EPC Can Help Your Business

• Energy-Efficient Lighting: Retrofit your lighting systems with energy-efficient LED technology to reduce consumption and maintenance costs.

• HVAC System Upgrades: Install high-efficiency heating, ventilation, and air conditioning (HVAC) systems to optimize comfort and cut energy expenses.

• Renewable Energy Integration: Integrate renewable energy systems such as solar panels or wind turbines to reduce dependence on external energy sources.

• Building Automation Systems: Install advanced energy management systems to monitor and control energy use across your facility in real-time.

• Energy Storage Solutions: Invest in energy storage systems to balance energy demand and increase overall energy security.

Who Can Benefit from EPC Financing?

• Commercial Buildings: Office complexes, retail spaces, and other commercial properties that need energy-efficient upgrades without upfront capital.

• Industrial Facilities: Manufacturing plants, processing facilities, and warehouses looking to reduce energy costs while maintaining operational efficiency.

• Healthcare and Educational Institutions: Hospitals, universities, and schools seeking sustainable solutions to reduce energy consumption and operating costs.

• Municipalities and Government Agencies: Public sector organizations seeking to achieve energy efficiency goals while managing tight budgets.

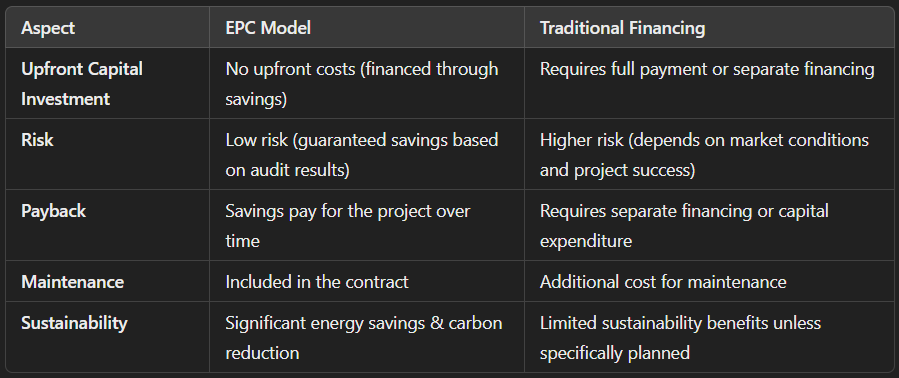

EPC vs Traditional Financing Models

EPC Financing Process

1. Energy Audit: We assess your energy use and identify savings opportunities.

2. Project Design: A customized energy solution is designed based on your needs and goals.

3. Financing: We arrange for the project to be financed through guaranteed energy savings.

4. Implementation: The energy-saving measures are installed and fully managed by our team.

5. Monitoring & Support: We ensure your systems continue to perform efficiently over time, guaranteeing savings.

Ready to Unlock Energy Savings with EPC?

The EPC financing model is a smart way to achieve energy savings and sustainability without the upfront investment. Let us guide you through the process of transforming your energy systems while preserving your capital.

Contact Us Today!

Schedule a consultation to learn how our EPC financing model can help your business reduce energy costs and boost sustainability.