ESCO Financing

How Does the ESCO Model Work?

The ESCO model works by providing energy efficiency upgrades without the need for initial capital investment. Here’s how it typically unfolds:

1. Energy Audit & Assessment

• The process begins with a thorough energy audit to evaluate your facility’s current energy consumption, inefficiencies, and areas for improvement.

• The audit serves as the basis for designing a custom solution that meets your energy-saving goals.

2. Customized Energy Solution Design

• Based on audit results, the ESCO designs a tailored energy-saving strategy, which may include upgrading HVAC systems, lighting, building automation systems, renewable energy integration, and more.

• The ESCO will also propose a financing structure, ensuring the project remains cost-neutral or cash flow positive.

3. Financing the Project

• The ESCO arranges the necessary financing for the project, often through a third-party lender, while the client does not need to make an upfront capital investment.

• The client repays the financing through the energy savings generated by the improvements.

4. Implementation & Installation

• The ESCO manages the design, installation, and commissioning of energy-saving measures, ensuring minimal disruption to your operations.

• The project may include energy-efficient upgrades to lighting, HVAC, insulation, renewable energy solutions, and more.

5. Performance Guarantees & Savings

• The ESCO guarantees energy savings, ensuring that the implemented solutions will deliver the promised savings.

• If the savings fall short, the ESCO typically covers the difference, further reducing the risk to the client.

6. Ongoing Monitoring & Maintenance

• The ESCO continuously monitors the performance of energy-saving systems and ensures proper maintenance to achieve sustained savings.

• Regular performance reviews and reporting are provided, ensuring the systems continue to deliver optimal results.

7. Project Completion & Ongoing Benefits

• Once the project is complete and fully financed through savings, the client enjoys continued energy savings, often long after the financing term ends.

Benefits of the ESCO Model

• No Upfront Capital: The ESCO model allows you to implement energy-saving projects without requiring initial capital outlay.

• Guaranteed Savings: Energy savings are guaranteed by the ESCO, ensuring that your investment is financially viable.

• Risk-Free: The ESCO assumes the risk of project performance, guaranteeing savings or covering any shortfall.

• Cash Flow Positive: The savings generated by the project typically exceed the costs of financing, creating a cash flow positive situation from day one.

• Long-Term Sustainability: Achieve long-term energy savings and sustainability goals with minimal impact on your operating budget.

• Operational Efficiency: Improve overall building and system performance, reducing maintenance costs, improving occupant comfort, and enhancing overall efficiency.

How ESCO Can Help Your Business

• Energy-Efficient Lighting: Retrofit lighting systems with energy-efficient LEDs to significantly reduce electricity costs.

• HVAC System Upgrades: Implement energy-efficient heating, ventilation, and air conditioning (HVAC) systems to improve comfort and reduce energy consumption.

• Building Automation: Install advanced energy management systems to monitor and optimize energy usage in real-time.

• Renewable Energy Integration: Transition to renewable energy solutions like solar panels, wind power, and geothermal energy to reduce reliance on external energy providers.

• Energy Storage Solutions: Implement energy storage systems to store excess energy and optimize energy use during peak demand.

Ideal Applications for the ESCO Model

• Commercial Real Estate: Office buildings, shopping centers, and retail stores looking to reduce energy costs and improve building performance.

• Industrial Facilities: Manufacturing plants and warehouses seeking energy efficiency improvements while minimizing operational disruptions.

• Healthcare Facilities: Hospitals, clinics, and healthcare centers requiring energy-efficient upgrades to meet sustainability goals.

• Government & Educational Institutions: Public sector organizations and universities that need energy-saving solutions but face budget constraints.

• Hospitality: Hotels, resorts, and restaurants looking to reduce energy consumption and improve guest comfort.

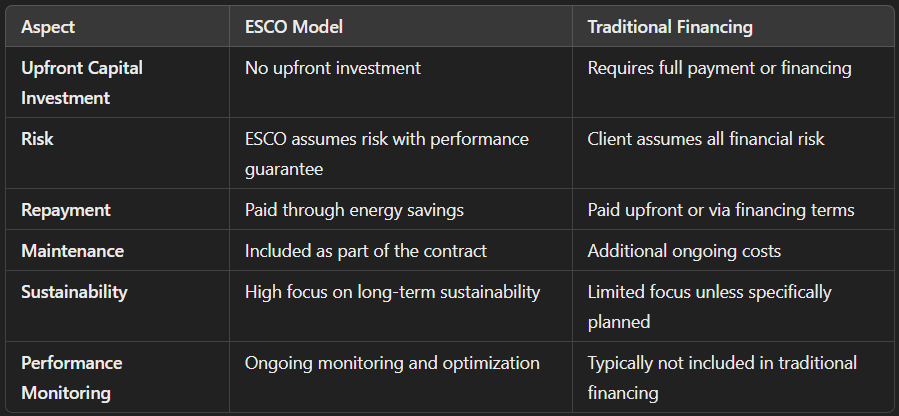

ESCO vs Traditional Financing Models

ESCO Financing Process

1. Energy Audit: We assess your current energy use and identify savings opportunities.

2. Solution Design: A customized energy-saving solution is designed, based on your specific needs and goals.

3. Financing: We arrange financing for the project, which is paid off through the energy savings.

4. Implementation: The energy-saving technologies are installed and fully managed.

5. Ongoing Monitoring: We continuously monitor performance to ensure energy savings are maximized and maintained.

Real-World ESCO Solutions

• Energy-Efficient Lighting Upgrades: Replace traditional lighting with energy-efficient LED solutions to reduce energy consumption and operational costs.

• HVAC System Optimization: Retrofit heating, ventilation, and air conditioning systems with energy-efficient units and automated controls for optimal performance.

• Building Automation and Controls: Implement energy management systems that automatically adjust lighting, heating, and cooling based on occupancy and usage patterns.

• Renewable Energy Integration: Transition to on-site solar, wind, or other renewable energy sources to reduce your reliance on traditional energy sources.

Ready to Start Saving with the ESCO Model?

The ESCO financing model provides a sustainable, low-risk way to achieve energy savings and enhance your building’s performance without the need for upfront capital. Let us help you reduce your energy costs while improving efficiency and sustainability.